Do you know many Americans are less bothered about having wills and estate planning? While many give excuses like it’s too expensive to set up, or I have no assets to pass on to another person. Some say I don’t know my way around it.

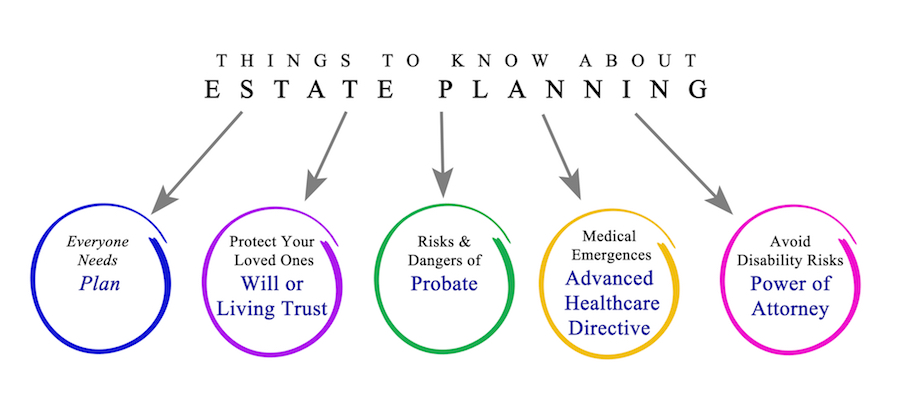

It is essential to have a form of estate planning in place for your properties to get to the proper parties you intended after your demise.

According to the 2022 Wills Survey carried out by Caring.com, about two-thirds of young adults in the US don’t have an estate plan document.

Further, about 50% more young adults between 18-34 now have a form of an estate planning document in place as opposed to before the COVID-19 pandemic. Interestingly, more wealthy people are also likely to have estate plans, according to the survey.

What is Wills & Estate Planning?

An estate plan is an array of legal documents that indicates your wishes for your property distribution and management, healthcare decisions, and guardianship of your children.

This plan helps distribute the deceased’s assets to the right persons and allocate guardians to children and other activities.

In the same vein, estate planning is simply the arrangement made by an individual to manage and distribute their property while still alive, incapacitated, or dead. This includes planning how all real, intellectual, and personal properties will be collected and distributed.

Estate planning documents include last will and testament template, revocable trust, beneficiary designations, health care power of attorney, durable power of attorney, guardianship designations, account lists (including financial accounts, retirement accounts, and bank accounts), property documents, and obligations, and contact lists.

Benefits of Wills and Estate Planning include;

- Save cost and avoid disputes

- Proper management of a testator property even when incapacitated.

- Proper Estate Assets Distribution of the demise

- Protection of beneficiaries

- Minimize estate taxes

In the remainder of this post, we will discuss the key estate planning component – a will. Because not everybody needs an estate plan, but everybody needs a will.

Estate Wills – Terms and Definitions

In explaining wills & estate planning, there are some essential terms you need to know to understand these concepts better. They include and are not limited to;

- Administrator – The person appointed by a probate court to protect and ensure proper distribution of the estate assets of an individual who dies without a will following the law. For an administrator to act for the estate, the administrator receives administration letters from the court, which are proof of authority to act.

- Beneficiary – This person receives money or property under a will. It could also be under a trust or insurance policy.

- Dying Intestate – implies dying without a will.

- An Estate – An estate refers to all the real and personal property owned by a demise.

- Estate Taxes – Estate Taxes are financial levies levied by the federal or state government on a deceased person’s estate.

- Executor/Executrix – An executor/executrix is an individual (male or female) a testator/testatrix appoints in a will to oversee the estate after they die. When the testator/testatrix dies, the executor/executrix has to ensure the protection and proper distribution of estate assets as outlined in the will. And just like an administrator, an executor/executrix has to obtain letters of testamentary from the probate’s court as proof of authority to act in charge and for an estate.

- Probate – This is the act of presenting the last will and testament of demise before the probate court.

- Probate court – A probate court, sometimes referred to as a surrogate court, is a segment of the judicial system that handles matters relating to the distribution of assets of an individual after the demise, according to Probate Law. Here, you can also find some probate laws from the US Department of State.

- Testator/Testatrix – A man or woman who writes/makes a will.

- Will – A will is a legal document that outlines an individual’s wishes concerning how their children should be taken care of and how their assets should be distributed after death.

Why should you draw a Will?

You need to draw a will to indicate who gets your assets and to what extent and to make it easier for them to access them.

When you do not draw the will, the assets might end up with people you do not want to have them, for instance, your ex-spouse. It also helps you identify who should care for your children, even if your spouse is incapacitated.

How is my estate taken care of with or without a Will?

If an individual writes a will before dying, the custodian of the will usually takes the will to the probate registry. Some processes are carried out to determine the will’s authenticity.

After successfully completing this process, some forms are signed, payment of estate-related taxes is made, then assets are distributed.

However, when a person dies intestate, the state law regarding the estate administration governs who inherits the assets. Generally, the assets are distributed to the family members, mainly, the children and spouse.

However, in situations where there are no spouses and children, the relatives inherit the assets.

What are the Common Types of Will?

There are four major wills, and your situation tells which one to use.

Simple will – A simple will includes who should inherit your assets and a guardian for your minor children.

Testamentary Trust Will – This will is suitable for an individual with heirs who are either minors or not mature enough to handle your assets independently. Thus, the assets are placed in a trust and handled and managed by a successor trustee. The individual also lists the beneficiaries and places conditions that must be satisfied before the beneficiaries can gain full access to the assets, for example, age.

Living Will – Unlike other forms of will that involve asset distribution and management, a living will is a will that describes what you want if you become incapacitated. It includes the type of medical treatments you want and who can make decisions in your stead.

Joint will – Joint will, or mirror will is used mainly by couples such that one spouse can inherit all the assets. Two or more parties append their signature to it, serving as the last will for all the parties involved.

Other types of will include an oral will, holographic wills, pour-over will, and online will.

Satisfactory Criteria for Estate Wills

It must be in a written format.

The individual drawing the will (testator or testatrix) must be at least 18 years of age at the point of making the will.

The will must be written without being coerced or manipulated; it must be a voluntary action.

When writing this will, the testator/testatrix must be of sound mind and understand everything put into writing.

Two witnesses (unrelated to the testator/testatrix) are required to be present at the writing of the will and should be able to attest to it.

The signature of the testator/testatrix and the witnesses must be on the documents and be appended in both parties’ presence.

It must be notarized.

Conclusion

At this stage, you can determine a suitable type of will for your heirs and the criteria to satisfy. When you write your will, you have saved your heirs from delays in accessing your assets and confusion among family members.