You get your salary every month. But the amount in your bank account is less than what your offer letter says. Where does the remaining money go?

It goes to the government as tax. This is called TDS.

What is TDS?

TDS means Tax Deducted at Source. Your company cuts some money from your salary as tax. They send this money to the government.

You don’t get to touch this money. It goes straight from your employer to the tax department.

Why Does This Happen?

The government needs money to run the country. They build roads, schools, and hospitals. This money comes from taxes that people pay.

Instead of asking you to pay a big amount once a year, they collect it monthly. This is easier for everyone.

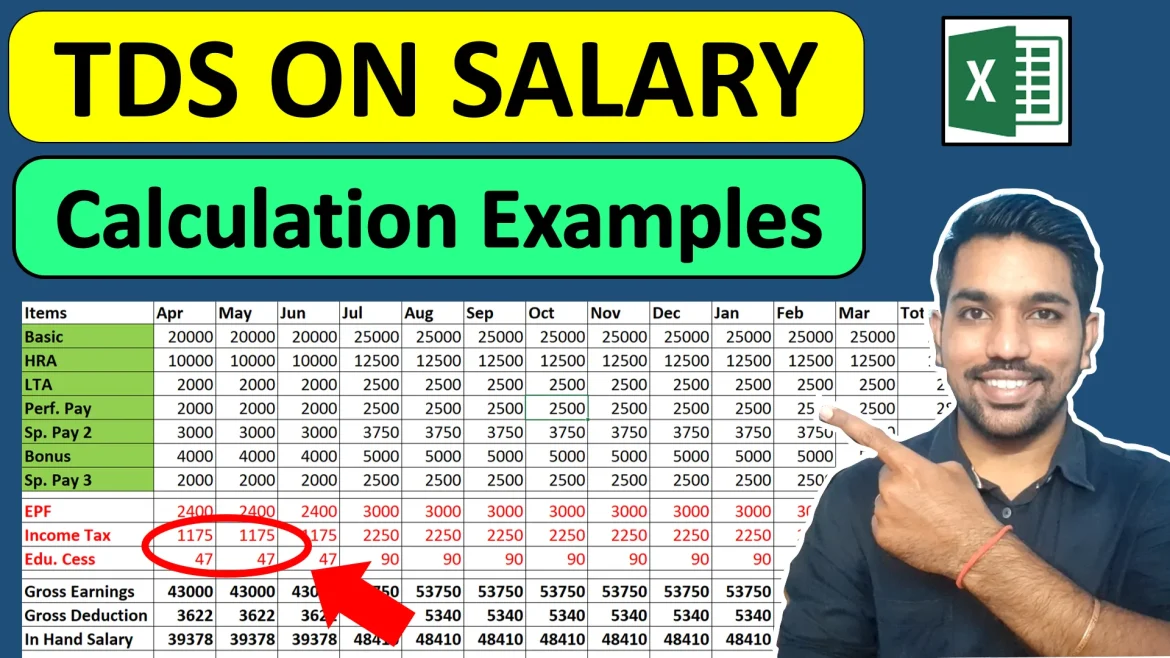

How Employers Calculate TDS

Your company looks at your total salary for the year. They check which tax slab you belong to. Then they figure out how much tax you need to pay.

This yearly tax is divided by 12. That becomes your monthly TDS amount.

But there’s more to it. The TDS calculation on salary also considers:

- Money you invest in certain schemes

- Home loan payments you make

- Insurance premiums you pay

- Medical insurance for your parents

All these things can reduce your tax. So your employer asks you to show proof of these investments. Based on that, they adjust your TDS amount.

What Happens to the Deducted Money?

Your employer collects TDS from your salary. They add TDS from all employees. Then they deposit this total amount with the government.

The government keeps a record. They know exactly how much tax was paid from your salary.

Understanding Form 16

At the end of every financial year, your employer gives you a paper. This is called Form 16.

Form 16 shows:

- How much you earned in the year

- How much TDS was cut each month

- Total tax paid on your behalf

Keep this document safe. You will need it later.

What is ITR E-filing?

ITR stands for Income Tax Return. Once a year, you need to tell the government about your earnings. You also show them the tax you already paid.

This process is called filing your return. Doing it online is ITR e-filing.

The government has a website for this. You log in, fill out some forms, and submit them. No need to visit any office.

The Connection Between TDS and Filing Returns

Here’s where things get interesting. The TDS cut from your salary matters a lot when you file your return.

You earned money. Tax was already paid through TDS. Now you need to match these two things.

You log into the tax website. You enter your salary details. You enter the TDS amount from Form 16.

The website does some calculations. It checks if the TDS amount was correct.

Three situations can occur:

Situation 1: TDS matches your actual tax. Nothing more to do. Your return is complete.

Situation 2: TDS was more than needed. The government owes you money. You get a refund.

Situation 3: TDS was less than required. You owe the government money. You need to pay the difference.

Why TDS Amount Can Be Wrong

Sometimes your employer cuts less TDS than needed. This happens when:

- You didn’t submit the investment proofs properly

- You have income from other sources, too

- Your calculations were incorrect

- You switched jobs mid-year

Sometimes TDS is more than needed. This happens when:

- You submitted investment proofs late

- Your actual investments were more than declared

- You had losses that reduced your taxable income

Steps for Filing After TDS Deduction

Get your Form 16 from your employer. Usually available by June.

Go to the income tax website. Create an account if you don’t have one.

Pick the correct form. For salary income, most people use ITR-1.

Fill in your salary details. The numbers come from Form 16.

Add any other income if you have it. Like rent from property or interest from savings.

Enter your TDS amount. Again, this comes from Form 16.

Add deductions you claimed. Like investments, insurance, and home loan.

The system calculates everything. It tells you if tax is pending or if you get a refund.

Submit the form. Verify it using your Aadhaar or other methods.

Getting Your Refund

If you paid extra tax through TDS, you can claim it back. This is called a tax refund.

After you file your return, the tax department checks your details. If everything is correct, they approve your refund.

The money comes directly to your bank account. This can take a few weeks to a few months.

But you only get a refund if you file your return. The government won’t send money automatically. You have to ask for it by doing ITR e-filing.

What If You Don’t File?

Filing your income tax return is mandatory if your income crosses a certain limit. Even if enough TDS was deducted, you still need to file.

Not filing leads to problems:

- You can’t claim refunds

- You might have to pay a penalty

- Future loan applications get rejected

- Visa applications become difficult

Even if you don’t owe any tax, filing is important. It creates a record of your income.

The Basic Logic

Think of it simply. You earn money. Government needs its share. Company pays it monthly on your behalf through TDS. At year-end, you confirm everything through filing returns.

The TDS calculation on salary decides how much goes out monthly. The ITR e-filing process confirms if that amount is right.

Both work together. Understanding both makes tax matters simple. You know where your money goes. You claim back extra payments. You avoid penalties for short payments.

Keep documents ready. File on time. Tax season becomes just another simple task to complete.