Transferring money from your bank account is easy. But the main problem is that it is expensive, and an international money transfer also takes up a lot of time.

Fortunately, many platforms may make your work easy, save time and a lot of money when you are transferring money online.

With Wise, formerly known as TransferWise, you can save up money online and transfer money quickly, incurring a very cheap cost.

When you use a bank, it may take days to transfer your money to your loved ones abroad, and Wise provides you the opportunity of same-day transfers.

Wise offers the best exchange change rates that you may ever encounter, and upfront fees are probably the lowest if you use this platform.

Below you will find a detailed process to find out how to open an account and send money internationally within minutes using Wise.

How To Open A Wise Account?

Needless to say, you already need to have a bank account before using Wise.

In this section, you will have a detailed guide on how to open a Wise account to make money transferring internationally easy and transparent.

How To Open A Wise Account – Detailed Guide

You can open a Wise account by following these 5 easy steps:

Step 1: Visit the Wise Website

Just simply search the website on Google or any popular search engine:

Snapshot was taken on 04/03/2022 from a Wise website.

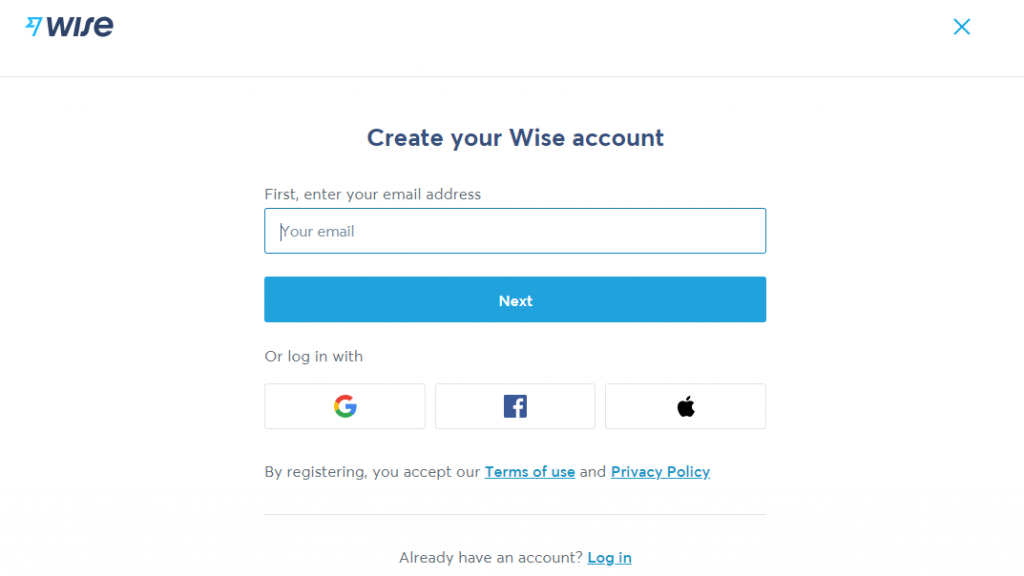

Step 2: Opt to Register Yourself

Click on the Register button to get your account ready with Wise.

Step 3: Enter Your Details, Registered Email Address, Create a Unique Password & Select The Country Where You Reside In

Step 4: Fill Out Your Personal Details & You Are Done!

The system will automatically generate an email along with a security code or a link in order to verify your contact information.

You’re now good to go and are now a part of the Wise family!

I’m In But, How Do I Start Sending Money Using Wise?

Now that you are registered with Wise, you may now easily access the website and log in.

Now, when arriving at this stage, you will be aware of the currency exchange rate and the amount that you will have to incur while transferring your amount.

You will also need to be sure that you put in the correct account details and beneficiary information.

Wise takes care of your funds and therefore, it will send a security code to your registered mobile phone. Wise Platform may also require a copy of the identification of your documents for additional safety.

Finally, you need to pay the fee and complete the transfer to successfully transfer funds to your desired location.

Keep in mind to track the status of your transfer as it can take 1 to 2 business days to reach its desired location.

What Is the Fees for Using Wise to Transfer Money?

Wise shows its users the commercial exchange rate rather than the higher tourist exchange rate.

As a result, the transfer rate might be nearly ten times lower than typical banks.

The fees charged vary depending on the amount being sent, the currencies being used, and the payment method selected.

The good news is that when you send money out, you can always see the costs and what they refer to on the simulation page.

Transfer Limits Set By Wise

You can only send a certain amount of data using Wise. The restrictions are determined by the currencies you send and receive, as well as the payment method you employ.

If you try to send more than the allowed amount, the platform will alert you.

The restrictions for each currency can be seen on the Wise Currencies pages.

Multi-currency Account with Wise

The Wise Multi-Currency account may be ideal for you if you live or plan to move abroad.

The account allows you to access international bank details and, as a result, receive money from over 80 countries, send money to over 80 countries, and convert your currency to over 50 currencies.

Is It Worth It To Use Wise To Make International Money Transfers?

Yes, it is correct. This is why:

Why should you Choose Wise?

- It’s simple and quick to open a Wise account, and it’s all done online.

- The platform is simple to operate.

- The exchange rates and costs are all clearly stated.

- Wise has the most affordable prices and expenses.

- Wise works with a diverse range of countries and currencies.

- In general, the transfer limitations are high.

It is safe: Financial Conduct Authority (FCA)-registered financial institution in the United Kingdom

If you haven’t tried wise banking services then click here and get your account now.