XM withdrawals are a key concern for traders who want fast access to profits and reliable fund security. Understanding how long XMTrading withdrawals take—and why timelines vary by method—helps traders manage cash flow, avoid unnecessary delays, and reduce scam-related anxiety. This guide explains XM withdrawal processing times, influencing factors, and best practices so traders can plan withdrawals efficiently and trade with confidence.

Overview of XM Withdrawal Process

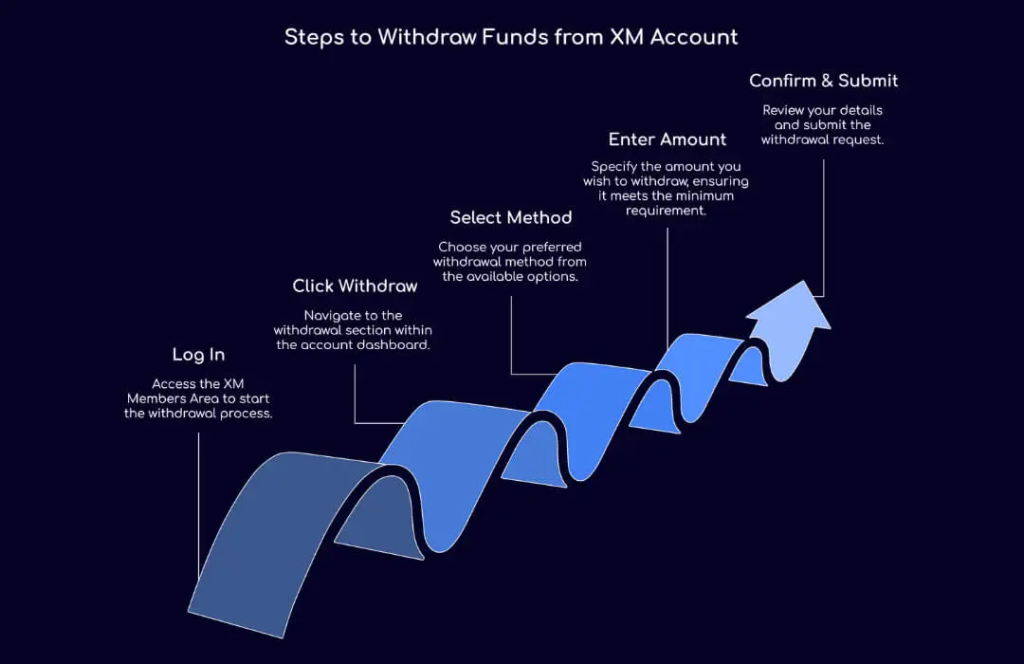

Before looking at timelines, it is important to understand how XM handles withdrawals internally.

How XM Processes Withdrawal Requests

XM processes withdrawal requests through its client area. Once a trader submits a request, XM reviews it for compliance, account verification, and payment method matching. Internal processing usually begins immediately and follows strict regulatory and anti-money laundering rules.

Why Withdrawal Speed Matters to Traders

Fast withdrawals are more than convenience—they are a trust signal. Delayed payouts often raise concerns about broker reliability. XM’s transparent withdrawal structure reassures traders that profits can be accessed without unnecessary obstacles.

XM Withdrawal Time by Payment Method

Withdrawal time at XM depends largely on the chosen payment method.

E-Wallet Withdrawals: Fastest Option

Withdrawals via e-wallets such as Skrill and Neteller are usually the fastest. Once XM approves the request, funds are often credited within 24 hours. This makes e-wallets ideal for active traders who need quick access to capital.

Credit and Debit Card Withdrawals

Visa and other card withdrawals typically take longer than e-wallets. After XM processes the request, funds may take 2–5 business days to appear, depending on the issuing bank. Card withdrawals follow strict refund rules for security reasons.

Bank Transfer Withdrawal Timelines

Bank transfers are commonly used for larger withdrawals.

International and Local Bank Transfers

Bank transfer withdrawals usually take between 2 and 5 business days after processing. The exact time depends on banking networks, country of residence, and intermediary banks involved.

Factors That Can Delay Bank Withdrawals

Public holidays, incorrect bank details, or additional compliance checks can slow down bank transfers. While XM does not charge withdrawal fees, banks may apply processing charges.

XM Internal Processing Time Explained

XM’s internal review plays a crucial role in withdrawal speed.

Standard Approval Time at XM

XM typically processes withdrawal requests within 24 hours on business days. Requests submitted outside working hours or during weekends are processed on the next business day.

Impact of Account Verification Status

Unverified or partially verified accounts may experience delays. Completing KYC verification early ensures smoother and faster withdrawals when profits are realized.

Withdrawal Rules and Compliance Considerations

Understanding XM’s withdrawal rules helps avoid confusion.

Same-Method Withdrawal Policy

XM follows a strict same-method withdrawal policy. Funds are returned to the original deposit method up to the deposited amount, with remaining profits withdrawn via alternative methods if needed. This policy enhances security and prevents fraud.

Bonus-Related Withdrawal Conditions

Bonuses cannot be withdrawn directly. Traders must meet trading volume requirements before profits generated from bonus funds become withdrawable. XM clearly outlines these conditions in the client area.

Common Reasons for XM Withdrawal Delays

Most delays are avoidable with proper preparation.

Incorrect Payment Details

Errors in bank account numbers, card details, or e-wallet IDs can cause withdrawals to fail or be delayed. Double-checking information before submission is essential.

High Market Activity and Compliance Checks

During periods of high market volatility or increased withdrawal volume, additional compliance checks may slightly extend processing times. This is part of XM’s commitment to secure fund handling.

Tips to Speed Up XM Withdrawals

Simple best practices can significantly reduce waiting time.

Verify Your Account Early

Completing identity and address verification immediately after registration helps ensure withdrawals are processed without interruption later.

Choose Faster Withdrawal Methods

Using e-wallets instead of bank transfers or cards generally results in quicker access to funds. Traders who prioritize liquidity often prefer this option.

How XM Compares to Other Brokers

Withdrawal speed is a competitive differentiator.

Industry Comparison on Payout Times

Compared to many retail brokers, XM’s internal processing time is relatively fast and transparent. Some brokers delay approvals for several days, while XM aims to process requests within one business day.

Trust and Reliability Perspective

Consistent withdrawal performance reinforces XM’s reputation as a regulated and trader-focused broker, particularly in markets like Japan where fund safety is a top priority.

Conclusion

XM withdrawal times depend mainly on payment method, account verification, and banking systems rather than broker delays. With internal processing typically completed within 24 hours and fast e-wallet payouts, XM offers a reliable withdrawal experience. For traders who value transparent fund access, strong regulation, and predictable processing times, XM remains a solid choice for managing profits securely and efficiently.